So, what Gains will not be A part of a cafeteria program? These are the advantages you cannot contain as part of your IRS segment a hundred twenty five approach:

A qualifying cafeteria prepare exists when an organization features its staff a choice in between cash and at the least just one other beneficial pre-tax benefit, which include team overall health insurance policy.

Choose-in demanded. Account have to be in excellent standing and chip-enabled debit card activated to decide in. Initial and ongoing immediate deposits are necessary for overdraft protection. Supplemental conditions could use which often can influence your eligibility plus your overdraft protection. Overdrafts are compensated at our discretion. Overdraft charges might lead to your account to generally be overdrawn by an amount that is greater than your overdraft protection.

You received’t get as much cash out of it, even so the interest fee is likely to generally be significantly lower, and you may use it to pay off not less than a part of your significant-fascination financial debt. Another option will be to do a cash-out refinance.

With a single, very simple sort, you could accessibility a network of lenders providing additional options to fulfill your preferences. Entire the form in minutes through the comfort and ease of your house, and when authorised, take pleasure in next-day direct deposit right into your account.

Providing an employer cell phone number considerably will increase your probability of acquiring a bank loan. If you are on Gains, you can use the telephone number of The federal government Place of work that provides your Advantages. Enter Employer Cell phone

Most worker benefit options are included by the Employee Retirement Income Safety Act (ERISA) and ought to also furnish a summary program description (SPD). An SPD is usually a simple-English Edition of the primary plan doc along with the adoption settlement, and it is supposed to inform staff in regards to the areas of the cafeteria program.

A section a hundred twenty five system offers workers with a possibility to get specific Positive aspects on the pre-tax foundation. This funds more info is taken from the individual's gross shell out and can be utilized for products for example team wellbeing insurance plan premiums, capable out-of-pocket medical bills, and daycare for qualified dependents.

The full-blown plan can be a shopper-driven healthcare (CDHC) strategy. It will involve a credit history procedure that the employee can use on the discretionary foundation for capable charges. Workforce can then dietary supplement the CDHC with their particular funds and utilize it to get more Positive aspects or coverage.

Businesses do not need to allow employees to create midyear election alterations other than Individuals beneath the HIPAA Particular enrollment legal rights.

In a bit one hundred twenty five approach, an employer sets apart a portion of an staff’s pretax wages to protect the costs of your program’s capable Rewards. The worker never ever gets this funds as aspect in their normal wages, so federal profits tax just isn't taken on these earnings.

There are times when an employer desires to make further payment accessible to staff members as an alternative to your employer’s share on the quality for health and fitness insurance.

Segment one hundred twenty five from the IRC prohibits companies from favoring hugely compensated persons and critical employees With regards to eligibility, Positive aspects and utilization beneath the prepare. Yearly nondiscrimination tests are required to make sure compliance Unless of course a secure harbor exemption applies.

Furnishing an employer phone number appreciably will increase your likelihood of getting a loan. If you are on Rewards, you can use the telephone number of The federal government Office environment that gives your Advantages. Enter Employer Phone

Ariana Richards Then & Now!

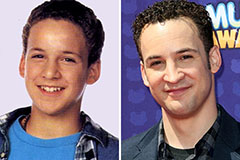

Ariana Richards Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!